-

- Abundante

- Adquirentes de pagos

- Ajustes

- Analítica

- Citas en línea

- Comercio Electrónico del Sitio Web de Odoo

- Configuración el Sitio Web de Comercio Electónnico

- Diseñe la Página de Su Sitio Web

- Gestión de Productos

- Gestión de Varios Idiomas

- Grupos

- Herramientas de fragmento

- Lista de precios

- Listado de productos

- Métodos de envío

- Múltiples compañías

- Múltiples sitios web

- Operaciones de blog en backd

- Pedido

- Personalización de la Página del Catálogo de productos

- Personalización del catálogo de productos

- Personalizar el menú y las apariencias

- Porcos

- Programas de cupón y promoción

- Publicar contenido específico para el sitio web

- RedirracionAmiento

- Salas de chat

- Sesión de Productos en la PESTAÑA CONFIGURACIÓN

- Sitio Web

- Tablero de Comercio Electrónico

- Tarjeta de Regalo

- Twitter Wall

- Visitantes

- Vistas de la Página

-

- Activo

- Adquirentes de pagos

- Biblioteca de contabilidad

- Catálogo de cuentas

- Conabilidad miscelána

- Configuración de Datos Bancario

- Contabilidad

- Contábilidad analíta

- Diario

- Estados de Cuenta Bancario

- Factura de Clientes al Pago

- Fechas de Bloqueo

- Fiscales de posiciones

- Gastos de Empleados

- Informa de de Socios

- Informa de seguimiento

- Informa en contabilidad

- Ingresos y Gastos Diferidos

- Mandatos de débito directo

- Notas de Crédito

- Pagos

- Pagos por lotes

- Presupuesto

- Reconciliatura

- Redondeo en efectivo

- Tablero de contabilidad

- Tipos de contabilidad

- Transferencias automáticas

- Términos de Pago

-

- Abundante

- Adquisico de Plomo

- CREACIÓN DE COTIZACIONES DE VENTAS

- CRM

- Caracteríssticas de Odoo 15 CRM

- Convertir LOS Cables en Oportunidades

- Cómo Odoo CRM Gestiona Las Oportunidades Perdidas

- FluJo de trabajo general de Odoo CRM

- Formulario de generación de plomo múltiples fuentes

- Funcionando -Con Clientes Potenciales

- Manejo de Liderazgo

- Nuevas Opciones en la ventana de configuración de Odoo 15

-

- Análisis de producción

- CREANDO CENTROS DE TRABAJO

- Fabricación

- Facturas de materiales

- Gestión de Chatarra

- Gestión de Mantenimiento

- Gestión de órdenes para no consultor

- Informe General de Efectividad del Equipo

- Pedidos de Fabricación

- Planificación de Pedidos Laborales por producción

- Planificación de órdenes de Trabajo por WorkCenter

- Programa de producció Maestra

- Órdenes de Trabajo

-

- Abundante

- Ajustes de Inventario

- Anuncios

- CARACTERÍSTICAS DEL MÓDULO DE INVENTARIO DE ODOO

- Categorizacia de productos

- Categorías de Almacenamiento

- Configuración del producto

- Confirmación de SMS en la Entrega

- Confirmación por Correo Electrónico en la Entrega

- Costos de Aterrizaje

- Empaquetado del producto

- Entrega

- Entregar Paquetes

- Estategias de Eliminación

- Gestión de Almacenes

- Gestión de Chatarra

- Integrando el Remitente de Terceros en Odoo

- Inventario

- Operaciones de inventario

- Planificadores

- Reglas de Caída

- Reglas y rutas

- Tiempos de Programació

- Trazabilidad del Producto

- Ubicacia

- Unidad de Medida

- Variantes de productos

-

- APEGO Salarial

- Abundante

- Configuración

- Contratos

- Entradas de Trabajo

- Estructuras salariales

- Información personal

- Nómina de Odoo

- OTROS TIPOS DE ENTRADA

- Parámetros de la regla salarial

- Reanudar

- Salarios de reglas

- Salpicaduras

- Tablero

- Tiempos de Trabajo

- Tipo de estructura salarial

- Tipos de Entrada de Trabajo

- Ventajas

Accounting - Odoo 15 Enterprise Book

Fiscal Positions

The fiscal positions in Odoo is a very beneficial tool when it comes to accounting. They assist in positioning the tax by overlooking the tax policy of the country. The one time tax setting it provides can be used every time. Taxes can be set on bothroducts and product categories, and this will automatically be added during sales orders. While making a sales order if you didn't select any fiscal policy, but the products are assigned tax, then the same tax will be applied to the invoice for every customer. Also if you didn't want to apply tax to certain customers, then it can be executed and managed with the fiscal policy. In the same way existing tax can be configured in Odoo. Fiscal positions can be set to individual customers and these will be applied at the time of invoicing.

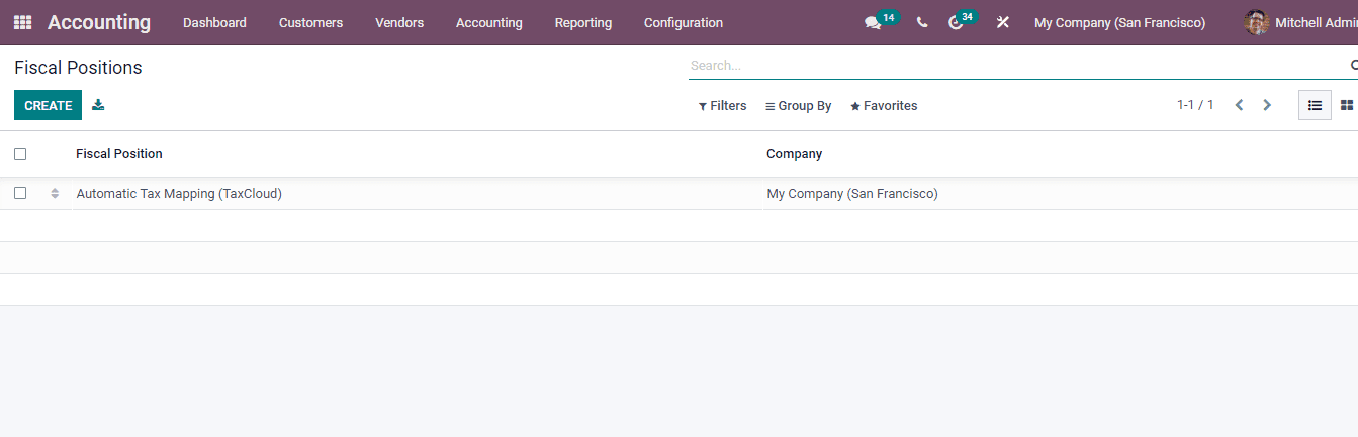

To configure the fiscal positions in Odoo 15 select the Fiscal Positions option from the Configuration tab. The list of existing fiscal positions configured will be displayed.

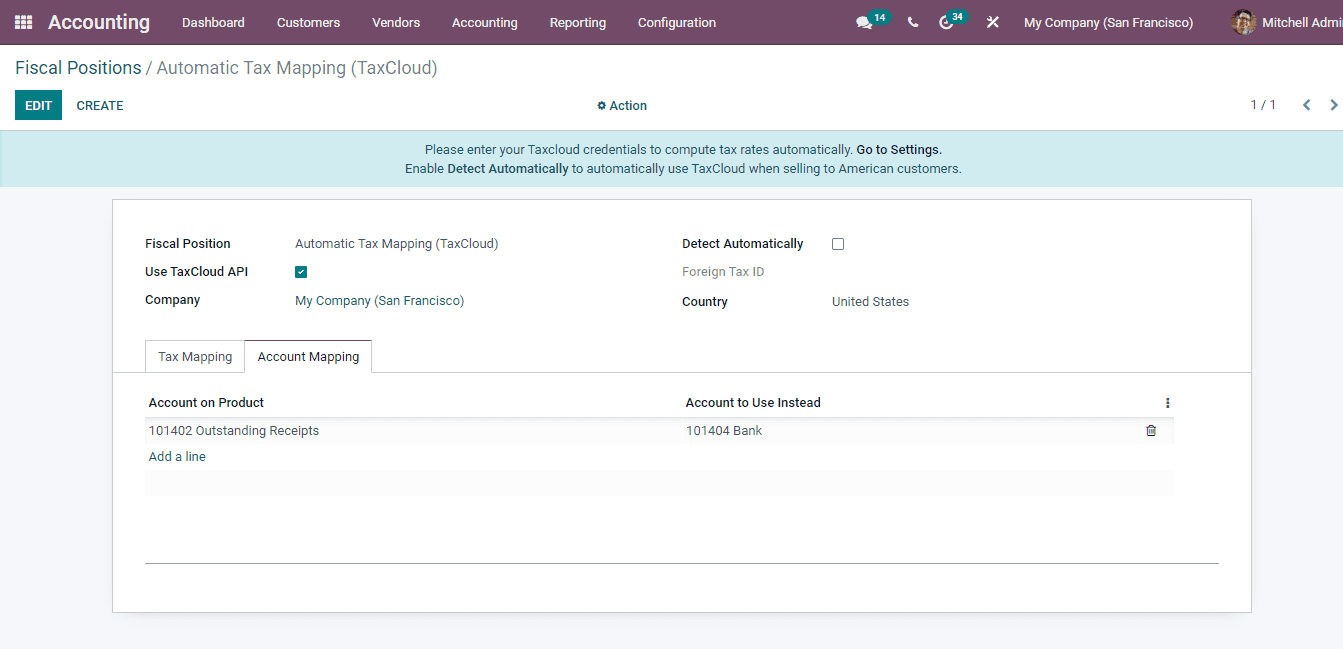

By selecting the fiscal position you can view the details of it. Here you can see that the tax on product and tax to be applied is defined. Also it clearly mentions on which account the cost must be shown.

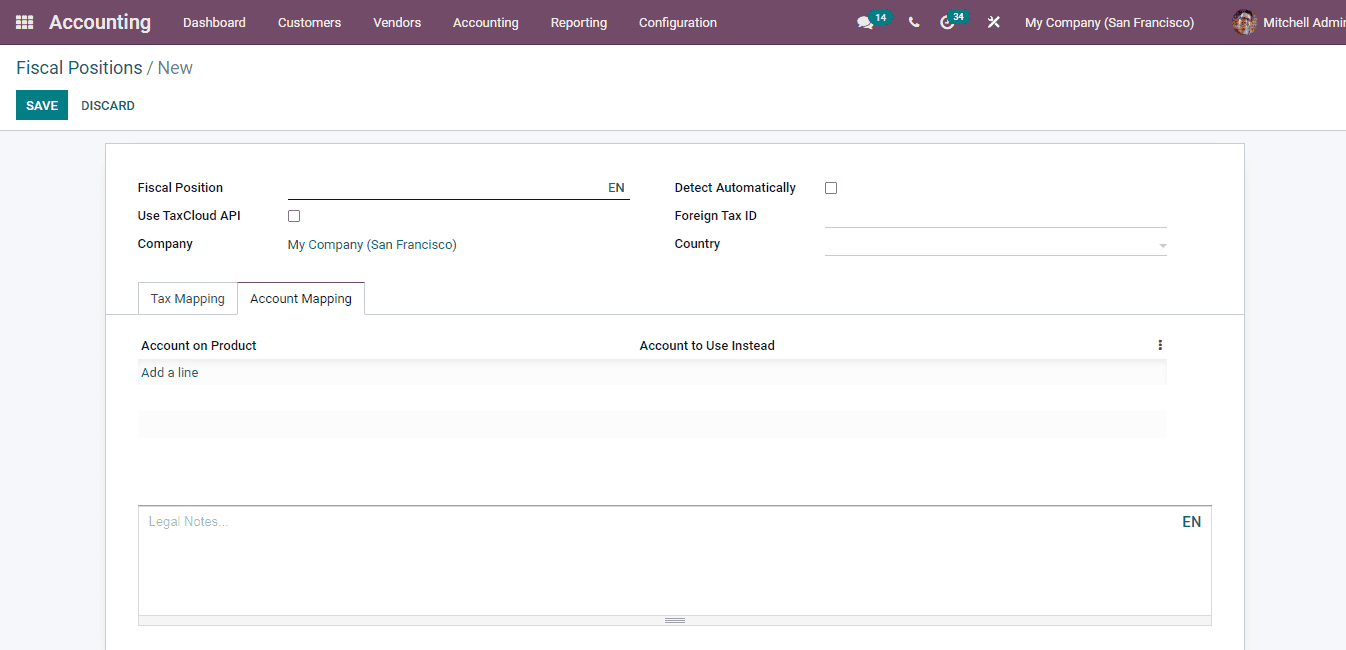

You can create new fiscal positions by selecting the CREATE button. Enter the name of the Fiscal Position along with details such as whether to Use Taxcloud API, foreign Tax ID, the tax ID of your company in the region mapped by the fiscal position and name of the Country. The fiscal position will only be applied if the delivery country matches. Under the Tax Mapping menu add the details of the Tax on Product and the Tax to Apply. You can add multiple products to the menu. Any legal notes regarding the fiscal position that must be printed on the invoice can be added to the dialogue box provided. After adding all the details select the SAVE button to add the new fiscal position to the system.