-

- Abundante

- Adquirentes de pagos

- Ajustes

- Analítica

- Citas en línea

- Comercio Electrónico del Sitio Web de Odoo

- Configuración el Sitio Web de Comercio Electónnico

- Diseñe la Página de Su Sitio Web

- Gestión de Productos

- Gestión de Varios Idiomas

- Grupos

- Herramientas de fragmento

- Lista de precios

- Listado de productos

- Métodos de envío

- Múltiples compañías

- Múltiples sitios web

- Operaciones de blog en backd

- Pedido

- Personalización de la Página del Catálogo de productos

- Personalización del catálogo de productos

- Personalizar el menú y las apariencias

- Porcos

- Programas de cupón y promoción

- Publicar contenido específico para el sitio web

- RedirracionAmiento

- Salas de chat

- Sesión de Productos en la PESTAÑA CONFIGURACIÓN

- Sitio Web

- Tablero de Comercio Electrónico

- Tarjeta de Regalo

- Twitter Wall

- Visitantes

- Vistas de la Página

-

- Activo

- Adquirentes de pagos

- Biblioteca de contabilidad

- Catálogo de cuentas

- Conabilidad miscelána

- Configuración de Datos Bancario

- Contabilidad

- Contábilidad analíta

- Diario

- Estados de Cuenta Bancario

- Factura de Clientes al Pago

- Fechas de Bloqueo

- Fiscales de posiciones

- Gastos de Empleados

- Informa de de Socios

- Informa de seguimiento

- Informa en contabilidad

- Ingresos y Gastos Diferidos

- Mandatos de débito directo

- Notas de Crédito

- Pagos

- Pagos por lotes

- Presupuesto

- Reconciliatura

- Redondeo en efectivo

- Tablero de contabilidad

- Tipos de contabilidad

- Transferencias automáticas

- Términos de Pago

-

- Abundante

- Adquisico de Plomo

- CREACIÓN DE COTIZACIONES DE VENTAS

- CRM

- Caracteríssticas de Odoo 15 CRM

- Convertir LOS Cables en Oportunidades

- Cómo Odoo CRM Gestiona Las Oportunidades Perdidas

- FluJo de trabajo general de Odoo CRM

- Formulario de generación de plomo múltiples fuentes

- Funcionando -Con Clientes Potenciales

- Manejo de Liderazgo

- Nuevas Opciones en la ventana de configuración de Odoo 15

-

- Análisis de producción

- CREANDO CENTROS DE TRABAJO

- Fabricación

- Facturas de materiales

- Gestión de Chatarra

- Gestión de Mantenimiento

- Gestión de órdenes para no consultor

- Informe General de Efectividad del Equipo

- Pedidos de Fabricación

- Planificación de Pedidos Laborales por producción

- Planificación de órdenes de Trabajo por WorkCenter

- Programa de producció Maestra

- Órdenes de Trabajo

-

- Abundante

- Ajustes de Inventario

- Anuncios

- CARACTERÍSTICAS DEL MÓDULO DE INVENTARIO DE ODOO

- Categorizacia de productos

- Categorías de Almacenamiento

- Configuración del producto

- Confirmación de SMS en la Entrega

- Confirmación por Correo Electrónico en la Entrega

- Costos de Aterrizaje

- Empaquetado del producto

- Entrega

- Entregar Paquetes

- Estategias de Eliminación

- Gestión de Almacenes

- Gestión de Chatarra

- Integrando el Remitente de Terceros en Odoo

- Inventario

- Operaciones de inventario

- Planificadores

- Reglas de Caída

- Reglas y rutas

- Tiempos de Programació

- Trazabilidad del Producto

- Ubicacia

- Unidad de Medida

- Variantes de productos

-

- APEGO Salarial

- Abundante

- Configuración

- Contratos

- Entradas de Trabajo

- Estructuras salariales

- Información personal

- Nómina de Odoo

- OTROS TIPOS DE ENTRADA

- Parámetros de la regla salarial

- Reanudar

- Salarios de reglas

- Salpicaduras

- Tablero

- Tiempos de Trabajo

- Tipo de estructura salarial

- Tipos de Entrada de Trabajo

- Ventajas

Accounting - Odoo 15 Enterprise Book

Journal

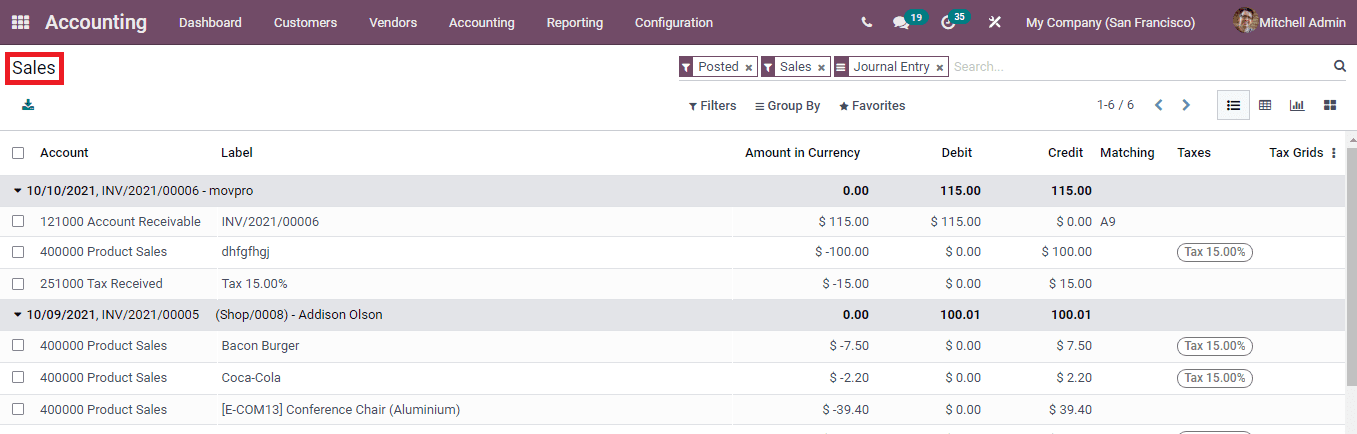

Sales

Las entradas del diario de ventas lo mantienen actualizado con las ventas de artículos comprados por los clientes.El lado de débito registra la cuenta por cobrar y acredita los ingresos.La mayoría de las ventas de inventario y las ventas de mercancías se registran en la revista de ventas.En el módulo de contabilidad Odoo 15, puede rastrear los registros de las revistas de ventas seleccionando la opción de venta desde la pestaña Contabilidad.

At the Sales journal, you can view the name of the Account, Label, Amount in Currency, Debit, Credit amount, Matching, Taxes and Tax Grids. The entries can be grouped by on the basis of Journal Entry, Account, Partner, Journal, and Date. Journals can be displayed in List, Pivot, Graph and Kanban view.

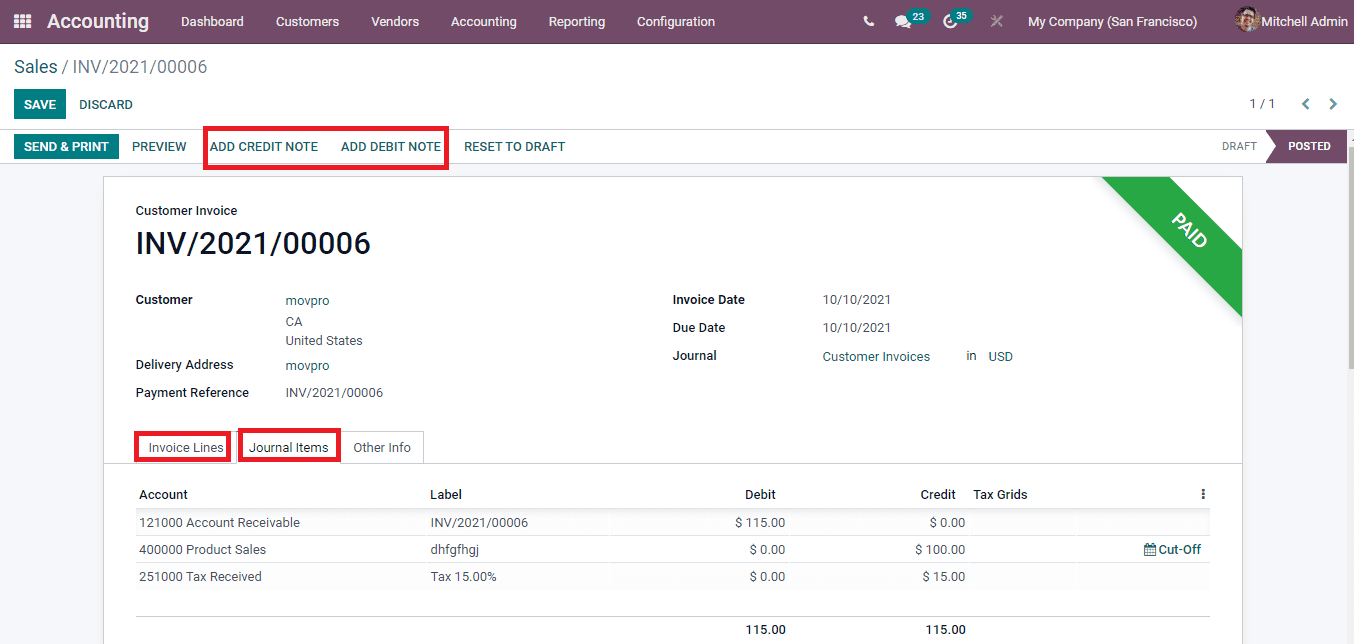

You can edit the details of the journal entry by selecting the edit icon. You will be redirected to the customer invoice profile. You can add credit notes and debit notes to the invoice by selecting the ADD CREDIT NOTE and ADD DEBIT NOTE buttons respectively. Printouts of the invoice can be taken and sent to the customers. By selecting the Invoice Lines you can view the details of the invoice lines. Similarly the journal items can also be checked.

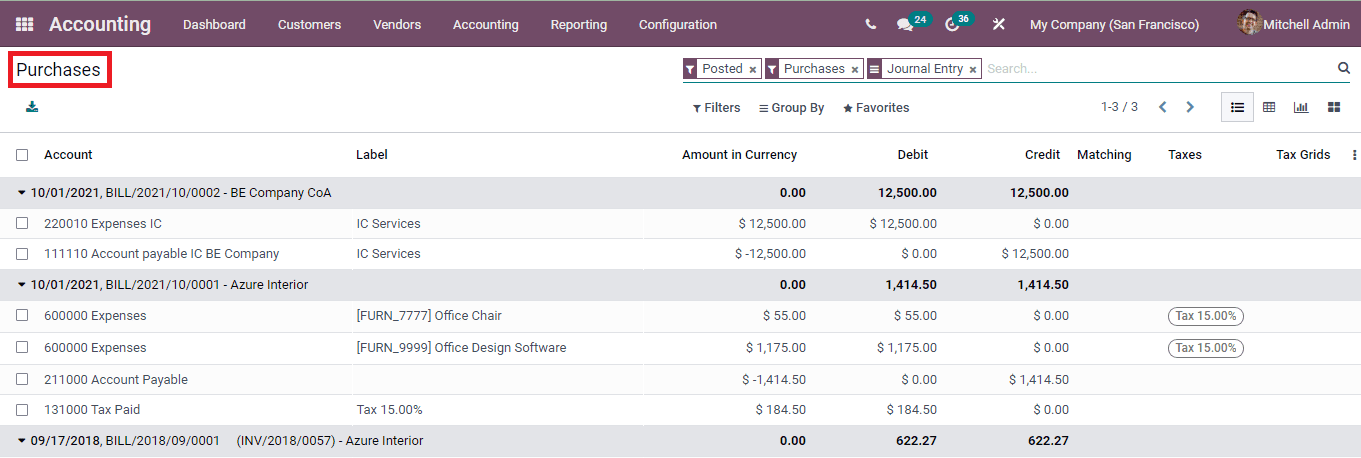

Purchases

All the acquisitions made by the company on credit during a period is recorded at thePurchase journal. With the help of a purchase journal you can keep a track of the orders placed by the company using the accounts payable.

Using the Odoo 15 Accounting module you can view the purchase journal by selecting the Purchase option from the Accounting tab. Similar to the Ses journal you can view the list of purchase journals along with the details such as name of the Account, Label, Amount in Currency, Debit amount, Credit amount, Matching and Taxes. You can reverse the journal entry by selecting the reverse icon. By selecting the edit icon you can edit the entry. Debit notes well as credit notes can be added to the invoices.

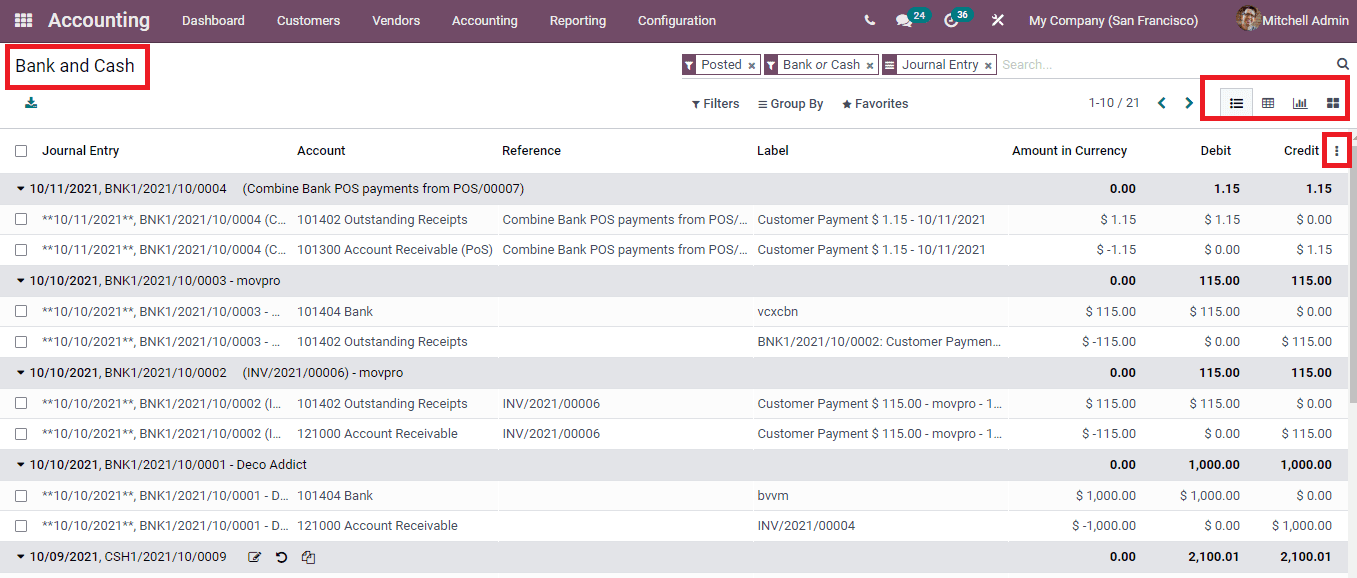

Bank and Cash

The selected documentâs bank and cash postings are recorded in the Bank and Cash journals. The transactions with the bank can be monitored and tracked with bank and cash journals. By selecting the Bank and Cash option from the Accounting tab you can view the bank and cash journal entries listed in the Odoo 15 Accounting module. Journal entries are displayed along with the details such as name of the Journal Entry, Account, Reference, Label, Amount in Currency, Debit amount and Credit amount is displayed. More measures can be displayed by selecting the three dots situated at the end of the details. The entries can be seen in List, Pivot, Graph and Kanban view.

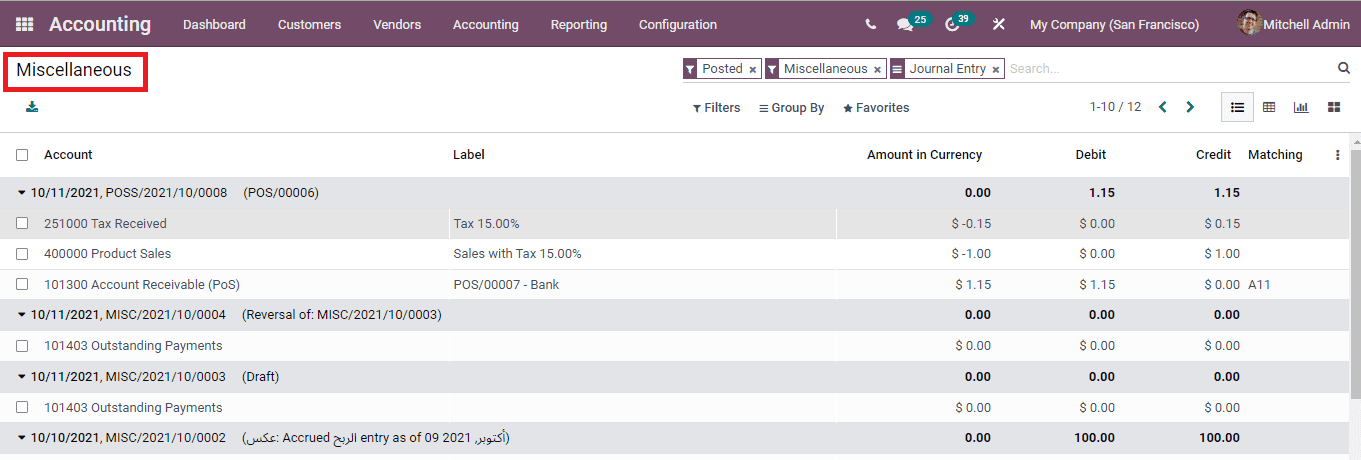

Miscellaneoush

Miscellaneous journal entries record the invoices, payments which do not fit within the specific categories or account ledgers of the company In Odoo 15 you can ew the details of such journal entries by selecting the Miscellaneous option from the Accounting tab. You can reconcile the journal entries that are displayed by selecting them and then pressing the RECONCILE button. The entries can be edited and reversed from the list.