-

- Abundante

- Adquirentes de pagos

- Ajustes

- Analítica

- Citas en línea

- Comercio Electrónico del Sitio Web de Odoo

- Configuración el Sitio Web de Comercio Electónnico

- Diseñe la Página de Su Sitio Web

- Gestión de Productos

- Gestión de Varios Idiomas

- Grupos

- Herramientas de fragmento

- Lista de precios

- Listado de productos

- Métodos de envío

- Múltiples compañías

- Múltiples sitios web

- Operaciones de blog en backd

- Pedido

- Personalización de la Página del Catálogo de productos

- Personalización del catálogo de productos

- Personalizar el menú y las apariencias

- Porcos

- Programas de cupón y promoción

- Publicar contenido específico para el sitio web

- RedirracionAmiento

- Salas de chat

- Sesión de Productos en la PESTAÑA CONFIGURACIÓN

- Sitio Web

- Tablero de Comercio Electrónico

- Tarjeta de Regalo

- Twitter Wall

- Visitantes

- Vistas de la Página

-

- Activo

- Adquirentes de pagos

- Biblioteca de contabilidad

- Catálogo de cuentas

- Conabilidad miscelána

- Configuración de Datos Bancario

- Contabilidad

- Contábilidad analíta

- Diario

- Estados de Cuenta Bancario

- Factura de Clientes al Pago

- Fechas de Bloqueo

- Fiscales de posiciones

- Gastos de Empleados

- Informa de de Socios

- Informa de seguimiento

- Informa en contabilidad

- Ingresos y Gastos Diferidos

- Mandatos de débito directo

- Notas de Crédito

- Pagos

- Pagos por lotes

- Presupuesto

- Reconciliatura

- Redondeo en efectivo

- Tablero de contabilidad

- Tipos de contabilidad

- Transferencias automáticas

- Términos de Pago

-

- Abundante

- Adquisico de Plomo

- CREACIÓN DE COTIZACIONES DE VENTAS

- CRM

- Caracteríssticas de Odoo 15 CRM

- Convertir LOS Cables en Oportunidades

- Cómo Odoo CRM Gestiona Las Oportunidades Perdidas

- FluJo de trabajo general de Odoo CRM

- Formulario de generación de plomo múltiples fuentes

- Funcionando -Con Clientes Potenciales

- Manejo de Liderazgo

- Nuevas Opciones en la ventana de configuración de Odoo 15

-

- Análisis de producción

- CREANDO CENTROS DE TRABAJO

- Fabricación

- Facturas de materiales

- Gestión de Chatarra

- Gestión de Mantenimiento

- Gestión de órdenes para no consultor

- Informe General de Efectividad del Equipo

- Pedidos de Fabricación

- Planificación de Pedidos Laborales por producción

- Planificación de órdenes de Trabajo por WorkCenter

- Programa de producció Maestra

- Órdenes de Trabajo

-

- Abundante

- Ajustes de Inventario

- Anuncios

- CARACTERÍSTICAS DEL MÓDULO DE INVENTARIO DE ODOO

- Categorizacia de productos

- Categorías de Almacenamiento

- Configuración del producto

- Confirmación de SMS en la Entrega

- Confirmación por Correo Electrónico en la Entrega

- Costos de Aterrizaje

- Empaquetado del producto

- Entrega

- Entregar Paquetes

- Estategias de Eliminación

- Gestión de Almacenes

- Gestión de Chatarra

- Integrando el Remitente de Terceros en Odoo

- Inventario

- Operaciones de inventario

- Planificadores

- Reglas de Caída

- Reglas y rutas

- Tiempos de Programació

- Trazabilidad del Producto

- Ubicacia

- Unidad de Medida

- Variantes de productos

-

- APEGO Salarial

- Abundante

- Configuración

- Contratos

- Entradas de Trabajo

- Estructuras salariales

- Información personal

- Nómina de Odoo

- OTROS TIPOS DE ENTRADA

- Parámetros de la regla salarial

- Reanudar

- Salarios de reglas

- Salpicaduras

- Tablero

- Tiempos de Trabajo

- Tipo de estructura salarial

- Tipos de Entrada de Trabajo

- Ventajas

Accounting - Odoo 15 Enterprise Book

Assets

Los activos juegan un papel importante en los negocios, ya que permite a la compañía aumentar y obtener ganancias, valor y mantener el negocio funcionando sin problemas.Es importante mantener un registro de activos, ya que ayudará a administrar los activos de la empresa.A través del registro de los activos, las partes interesadas pueden tener detalles de los activos que están disponibles con la Compañía y pueden usarse para obtener las ganancias o devoluciones anticipadas.Con la gestión adecuada de los activos, se puede realizar la identificación y gestión de riesgos que provienen del uso de los activos.La conciencia de los activos perdidos y dañados se puede hacer fácilmente con los registros.

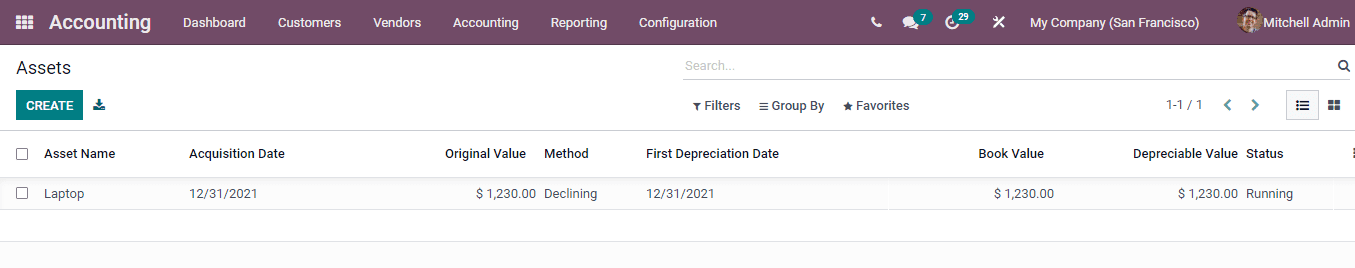

En el módulo de contabilidad Odoo 15, puede administrar los activos de la empresa seleccionando los activos.Los activos se enumeran con los detalles como

Asset Name - which indicates the name of the belonging asset.

Acquisition Date - the date on which the asset was acquired by the company.

Original Value - the original cost of the asset when it was bought.

Method - the method used for calculating the depreciation of the asset.

First Depreciation Date - the date on which the first depreciation was calculated on the asset.

Book Value - the value of the asset after reducing the depreciation.

Depreciable Value - this represents the assetâs used value.

Status- status of the asset is denoted here.

Using the Filters you can display the assets which are Current, Closed and Archived. You can group the assets on the basis of Date and Asset Model. The assets of the company can be viewed in both List and in Kanban view.

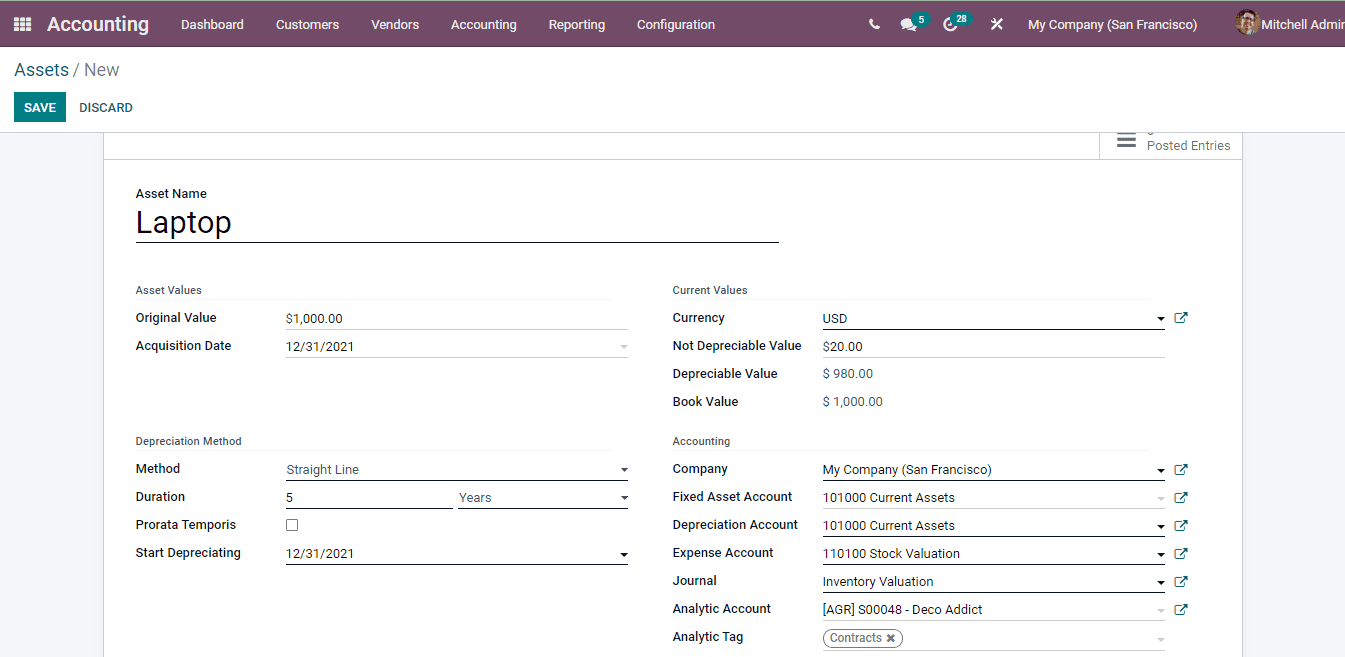

Creating new asset

When new assets are acquired by the company it should be recorded. In Odoo you save the data corresponding to the asset by selecting the CREATE option from the Assets window. The details to be entered in the New Asset form page are :

Asset Name : Enter the name of the asset purchased at this given field.

Original Value : In Odoo you can either set the original value manually or select the value from related purchases.

Acquisition Date : Enter the date on which the asset was purchased or acquired in this field.

Method: Here you will have to select the method for calculating depreciation of the asset. There are three methods available to estimate the depreciation, they are Straight Line, Declining and Declining then Straight Line method. In a straight line depreciation method the value of the asset decreases uniformly over each period. This will continue until the value reaches its salvage value. The declining method of depreciation is also known as the reducing balance method, in this method the assets are depreciated by applying a constant percentage of depreciation to the net value of the asset. Choose the method according to the asset.

Duration : Enter the number of depreciation needed to depreciate the asset in terms of years or months.

Prorata Temporis : By enabling the Prorata Temporis you will need to specify the start date for the first period depreciationâs computation. By default the date is set to the dayâs date rather than the start date of the fiscal year.

Start Depreciating : The date on which the depreciation must be started has to be inserted here. This date does not alter the computation of the first journal entry in case of prorata temporis assets. It only changes its accounting date.

Currency : Here enter the currency used to determine the values of the asset.

Not Depreciable Value : At this given field insert the amount you plan to have that you cannot depreciate.

Depreciable Value : The depreciable value will be automatically filled according to the Not Depreciable Value entered.

Book Value : At this given field enter the sum of depreciable value, the salvage value and book value of all value increase items.

Company : Name of the company which acquired the asset.

Fixed Asset Account : Enter the account used to record the purchase of the asset at its original price.

Depreciation Account : Add the account used in the depreciation entries, to decrease the asset value.

Expense Account : The account used in the periodical entries, to record a part of the asset as expense must be added here.

Journal : Add the journal related to the asset.

Analytic Account : This will help you in analysing and reviewing a single account.

Analytic Tag : Enter related tags which will help in making report generation and related operations simpler.

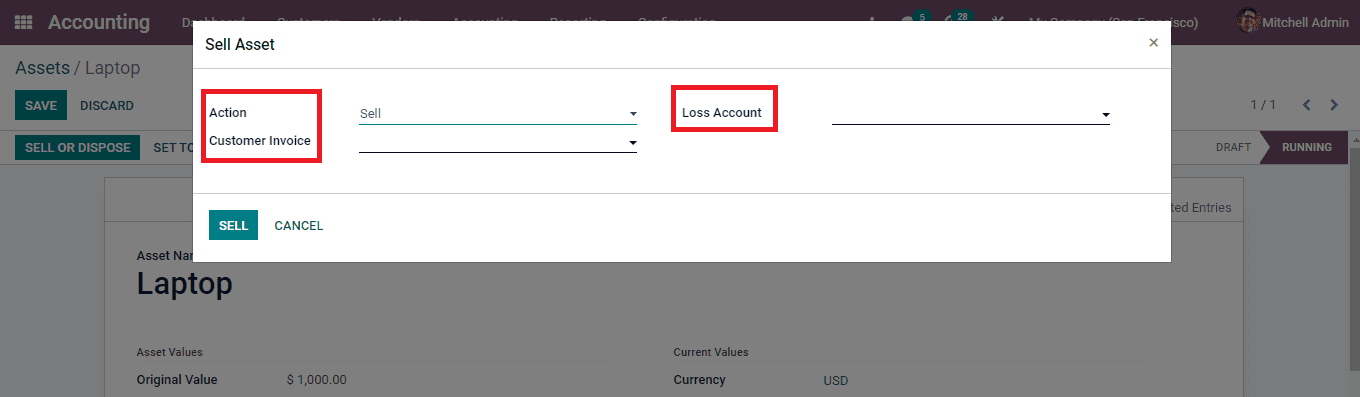

The depreciation can be calculated by selecting the COMPUTE DEPRECIATION button. By confirming the created asset you can either make moves to sell or dispose of the asset after using them. A Sell Asset window will appear on the screen after selecting the SELL OR DISPOSE button. At the window select an Action, either Sell or Dispose, Customer Invoice and Loss Account. By selecting the SELL/ DISPOSE button the entry will be recorded.

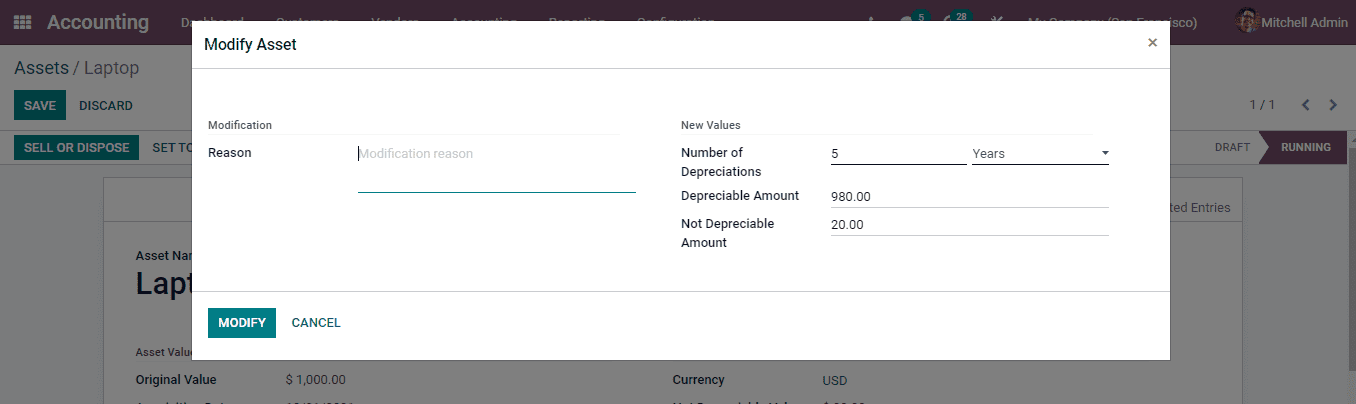

Changes can be made on the depreciation that was once created while recording the asset. You can pause the depreciation for certain dates by selecting the PAUSE DEPRECIATION button. Similarly alterations on the data related to depreciation can be made by selecting the MODIFY DEPRECIATION button. At the Modify Asset window enter the new details such as Reason for modifying the depreciation values, Number of Depreciation in terms of years or months, Depreciable Amount and Not Depreciable Amount. By selecting the MODIFY option new changes will be saved.

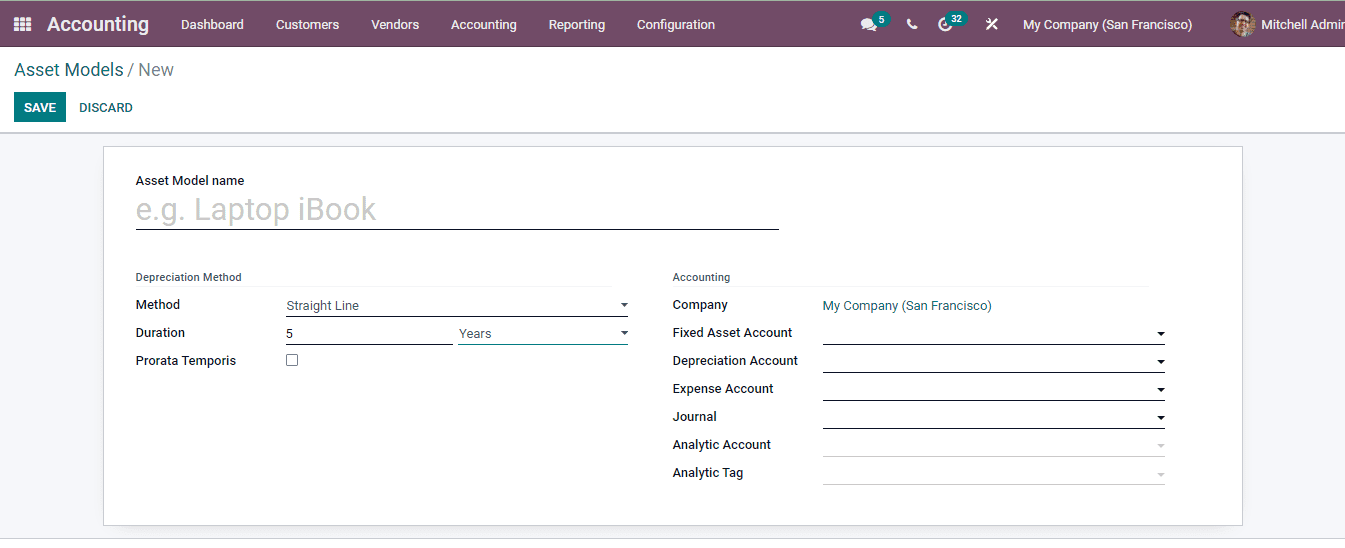

Creating Asset Models

Asset models help in managing the asset entries by setting up certain notions each asset may have. You can apply these asset models to the new entering assets so that the predetermined notion will get applied to the new asset. With a single asset model multiple assets can be created.

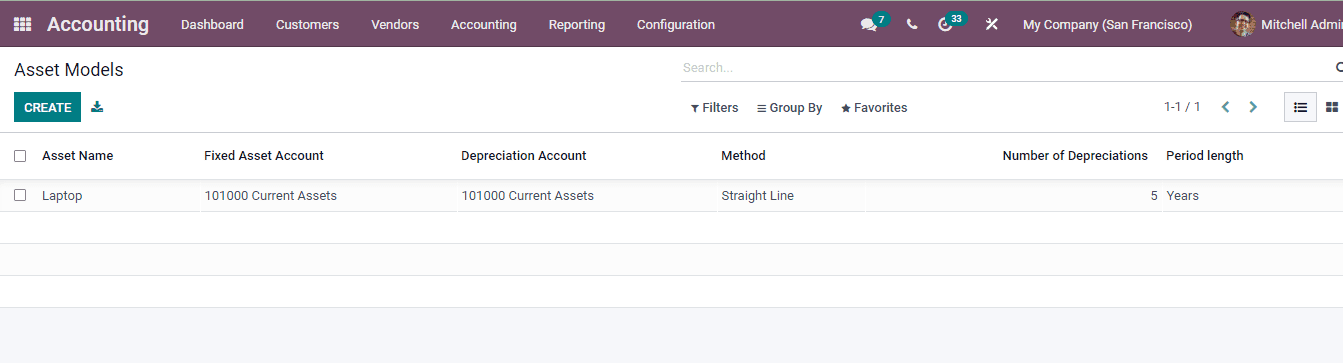

You can view the asset model by selecting the Asset Model option from the Configuration tab. The list of the models along with their Asset Name, name of the Fixed Asset Account, Depreciation Account, depreciation Method, Number of Depreciation and Period Length. The models can be grouped on the basis of Fixed Account, Depreciation Account, Expense Account and Journal.

Select the CREATE button to add a new asset model. The details that should be added to the new asset model form are:

Asset Model Name: Enter the name of the model that will be used while creating or adding new assets to the system.

Method: Choose a method that will be used to compute the depreciation amount. Odoo gives you three methods for calculating depreciation. Straight Line method, Declining and Declining then Straight Line method.

Duration: The number of depreciation needed to depreciate your asset. Also mention whether years or months are taken into consideration while calculating depreciation.

Prorata Temporis: Enable the option to specify the start date for the first periodâs computation.

Fixed Asset account: Enter the account used to record the purchase of the asset at its original price.

Depreciation Account: Add the account that is used to enter depreciations, to decrease the asset value.

Expense Account: Enter the account used to record a part of the assets as expense.

Journal: Add the corresponding journal that will be used to record the entries.

Select SAVE to validate the new asset model.