-

- Acuerdos de compra

- Advertencia

- Atributos del producto

- Categoria de ProductO

- Coincidencia de Recibos de Compra y Facturas de 3 Vías

- Compra

- Gestión de Productos

- Gotero

- Ordenes de Compra

- Receptores productos

- Reportes

- RequestForQuotationPurchaserOrder

- Unidad de Medida

- UnitfMeAsurectatecturaciones

- Vendorbills

- Vendormanagació

-

- Administrador

- Billofmateriales

- CREACIÓN DE DOCUMENTOS

- Categoría de equipos

- Configuraciones de WorkCenters

- CorrectiveMaintenancerequest

- Creando Merman Oferta

- Creando una orden de reparacia

- Enrutamiento

- Fabricación

- Gerencia

- Gerencia de Reparacia

- Gestión de la Calidad

- Gestión del Ciclo de Vida del Producto

- HowtounBuildOrder

- Manejo de Mantenimiento

- ManufacturingOrderManagement

- Mermanes de Creendo

- Nobildaproducto

- Orden

- Planificación de Trabajadores

- Planificante

- Preventivemaintenancerequest

- Productora de administración

- QualityControlpoints

- Reportes

- Subcontratacia

- WorkCenters y Rutings

- Workcenters

-

- Ajustes de Inventario

- Anuncios

- Capacidad de Productos

- Categorizacia de productos

- Configuración del producto

- Confirmación de Correo Electrónico de Entrega

- Consiguio un

- Coste de Aterrizaje

- Entrega

- Gestión de Almacenes

- Horario de Programació

- IntegratingthirdPartyshipper

- Inventario

- Operaciones de inventario

- Paquetes de Entrega

- Parpadeo

- Planificador

- ProductVariants

- Ratidrategas

- Reglas y rutas

- Reportes

- SMSCONFirmationAtDelivery

- Ubicacia

- Unidades de Medida

Odoo 14 book

Asset management

The asset management of the accounting aspects of a company are the financial operations of the sales, purchase, inventory operations, repairs and many more which are involved with the business concerning the financial operations. All the financial operations on these aspects can be planned, executed and monitored. In addition the physical assets such as land, vehicle, equipment etc. can be configured and subjected to a strict financial operations concerning the funds spent on them.

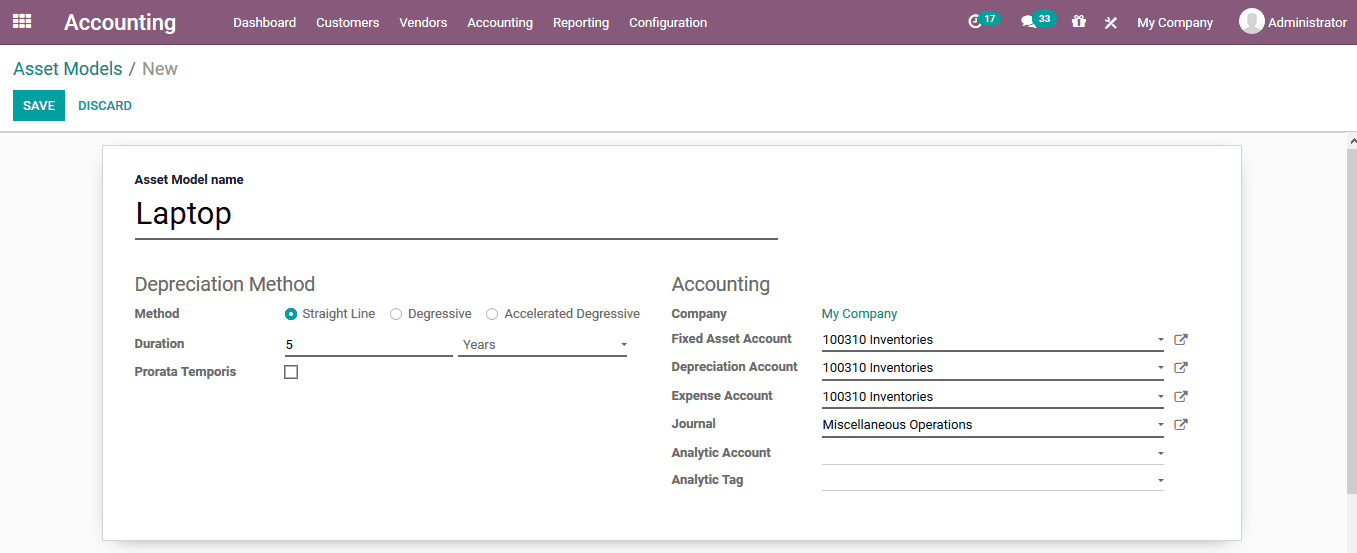

The asset model menu can be accessed from the configuration tab of the accounting module. In the menu all the asset models described will be listed out and the user can create a new one.

In the new asset creation window the user can assign an asset model, allocate the depreciation method to be a straight line, digressive or accelerated degradation. Additionally, allocate the duration and the prorata temporis. Under the accounting menu the user can describe the accounting aspect of the asset such as fixed asset account, depreciation account, expense account, journal, analytical account and analytical tab.

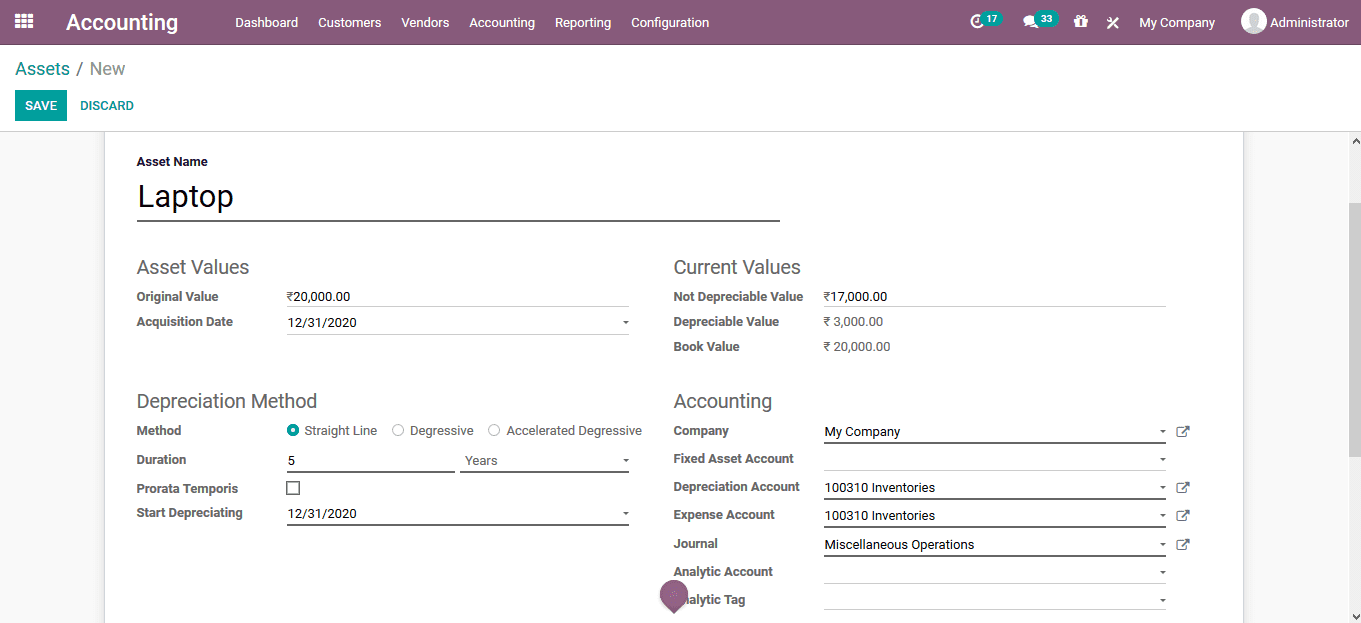

As the asset models are created the user can now create the various assets to be described in the company operations in the Odoo platform. To allocate an asset to the company the user can select the asset menu accessible from the accounting tab. Here all the assets of the model are being described and the user can select to get a new one.

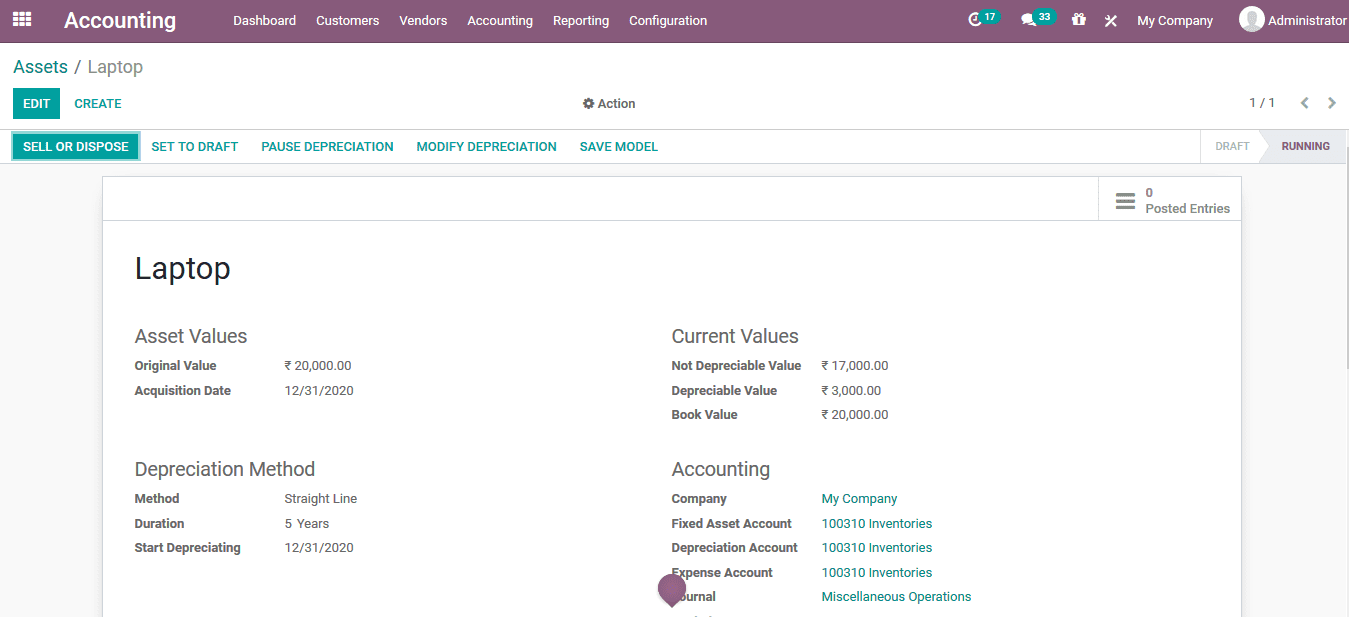

In the asset creation window the user should initially provide a name, allocate the asset value of the acquisition price and the date of it. Additionally, the current values can be described by the asset.

Furthermore, the depreciation method can be allocated and the duration of the depreciation and the start date of the depreciation can also be allocated. Moreover, the accounting aspects of the asset can be described under the menu such as depreciation account, expense account, journal of entry, analytical account and the analytical tab can be described.

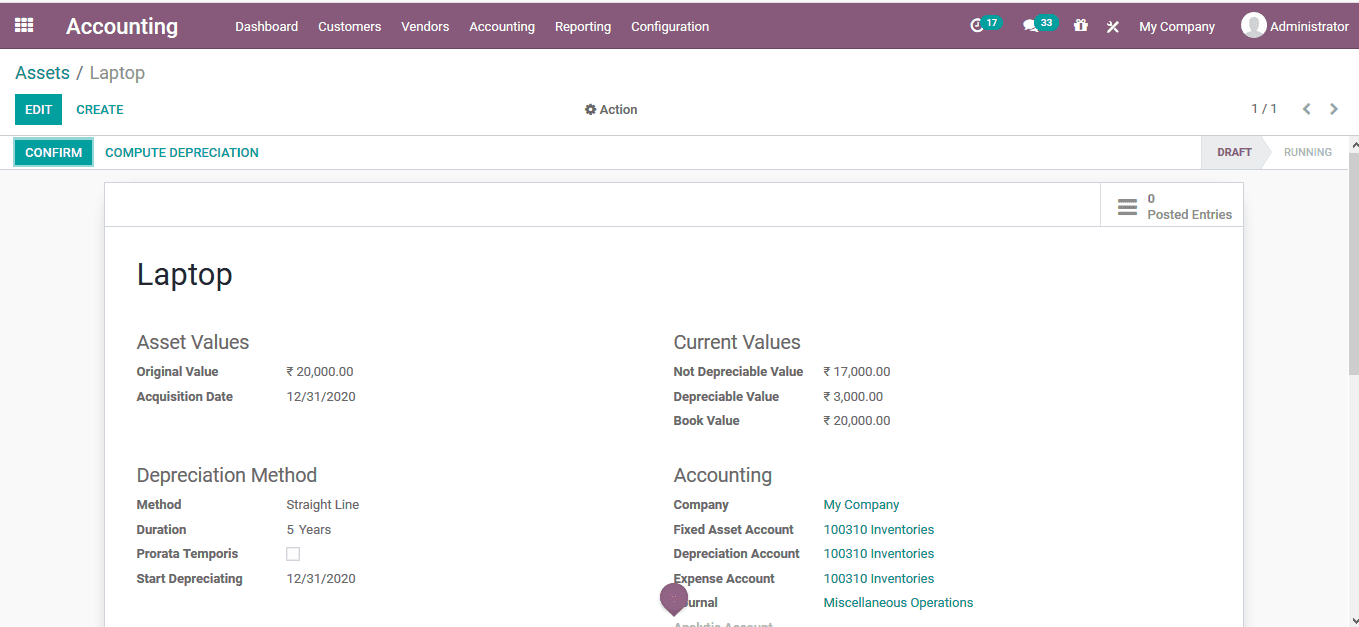

As the asset is being described and this is saved upon verification the user can view the option to confirm the asset to be described in the platform.

On confirming the asset the user can view the options sell or dispose, set as draft, pause depreciation, modify depreciation, and save the model.

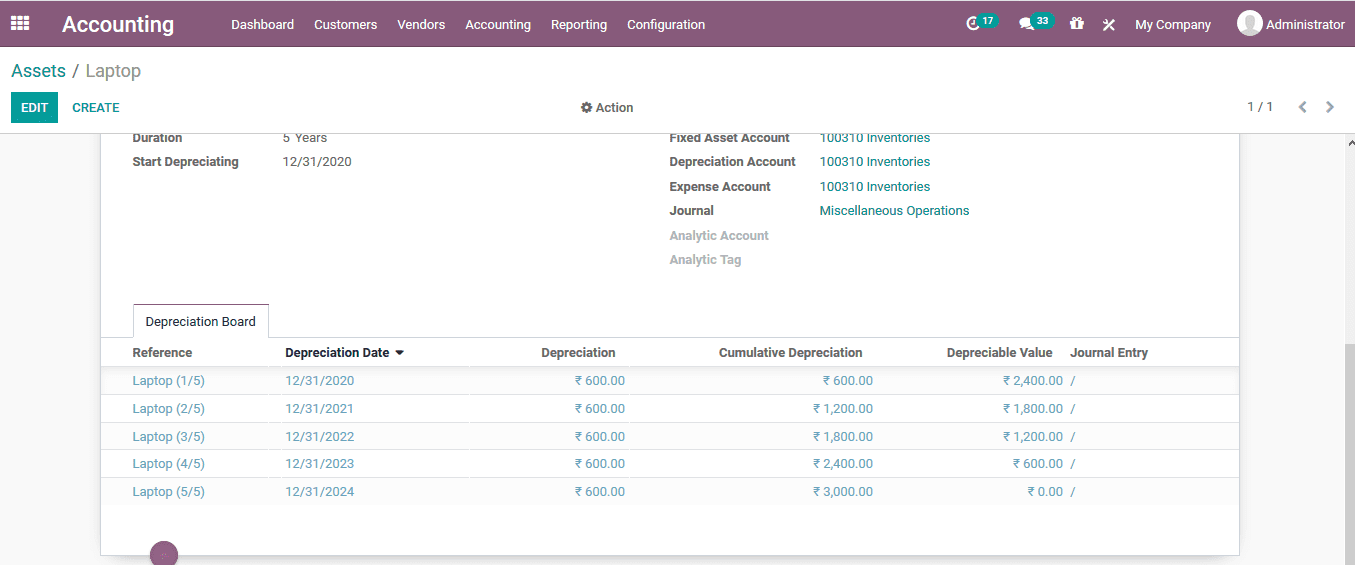

The depreciation board will be depicted down the depreciation board. Here all the reference of the asset and the details will be described.